Hurghada To Good An Opportunity?

The first airport transaction of 2026 has kicked off earlier than any Premier League games with Egypt’s Civil Aviation Ministry announcing the opening of a tender process for the management, operation and future development of Hurghada. While the tender had been expected for over a year the speed of the process is certainly ramping up with initial expressions of interest to be made by early February so is this an airport that’s worth investing in?

Where Is Hurghada – located on the Red Sea the airport is essentially a resort destination with stunning coral reefs, clear waters and a local population estimated at 280,00 across a mix of locals and expats from Africa, Europe and Russia with international schools making the location ideal for young families. While no definitive count of accommodation stock is available, a combination of hotels and local private rooms are filled by some nine million plus visitors each year and with prices offering great value for money compared to other destinations in the region Hurghada serves all possible markets.

Competitively while Sharm el Sheikh is 106 kilometres and Neom Bay 169 kilometres away both resorts are only accessible by lengthy boat trips and in the case of Neom most of the resorts remain unfinished and what accommodation stock there is appear to be priced for the very rich; and that is not Hurghada’s market.

Why Is Hurghada The First Airport For Privatisation In Egypt – with over 5 million seats and nearly 28,000 scheduled flights a year of which 4.7 million (94%) are to international destinations the airport is second only to Cairo. But importantly with such a high proportion of international leisure travellers the opportunity for increasing non-aeronautical revenues in the coming years makes the airport look a very interesting asset for any established airport operator who knows how to squeeze the last pound out of the departing passenger.

Importantly for the Civil Aviation Ministry they are selling an asset that just cannot stop growing and in estate agents’ terms, if recent growth is a sign of future opportunities, then very few airports can match the success of Hurghada. Since 2000 Hurghada was an increasingly popular destination with capacity reaching 2.7 million in 2019 the growth posts the pandemic has been quite remarkable with capacity nearly doubling in the last six years to 5.1 million seats and that growth has nearly all been in the international capacity. And remarkably the markets that have seen the greatest growth in the last six years are probably not quite what you would expect.

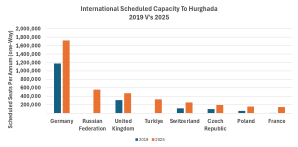

Surprisingly Germany is the largest market with capacity growth of some 46% and when you consider that in the context of the total international market from Germany still being 5% below 2019 levels that increase in volume is quite remarkable. Intriguingly Russia is the second largest market and while it may look like capacity has come from nowhere in the last six years a change from charter to schedule flight designation is behind what looks like stellar growth.

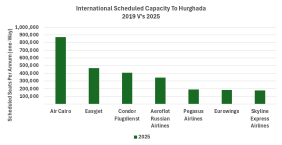

All Major Airlines Are In The Market, Or Are They? – the list of existing airlines operating international services includes many of the majors in the short and medium haul markets as the chart below highlights but that doesn’t mean there isn’t room for further growth in the coming years. While Air Cairo are the largest operator, EasyJet with their multiple European bases is an important supplier of capacity along with Condor and Eurowings the three airlines have the German market in their control. Intriguingly though we can see at least three major airlines that should be in the market that have yet to launch services and at least two of those have looked at the market in the past and with future fleet orders are likely to start services sooner rather than later, especially if the right commercial terms can be agreed.

And perhaps one of the most attractive aspects of Hurghada is that international seasonality is consistent across the year with November the busiest month with an average of 15,800 seats a day and February the quietest with some 11,900 so not a great swing across the year which adds to the appeal of the airport for an operator.

Is This Too Good An Opportunity To Miss? – while the sale process will take some time and be detailed and the traffic volumes have increased strongly in the last few years, the real challenge is going to be around forecasting future growth and the mix of traffic and carriers. Especially when there are strong linkages to accommodation stock and surely recent capacity growth cannot continue at the same rates or can it?

At MIDAS Aviation we’ve a lot of experience of markets such as Hurghada and deep relationships with airlines and operators that allow us to provide both forecast and the required reasoning behind those numbers. So, if you are interested then let us know!

-John Grant